Best Low Cost Index Funds 2025

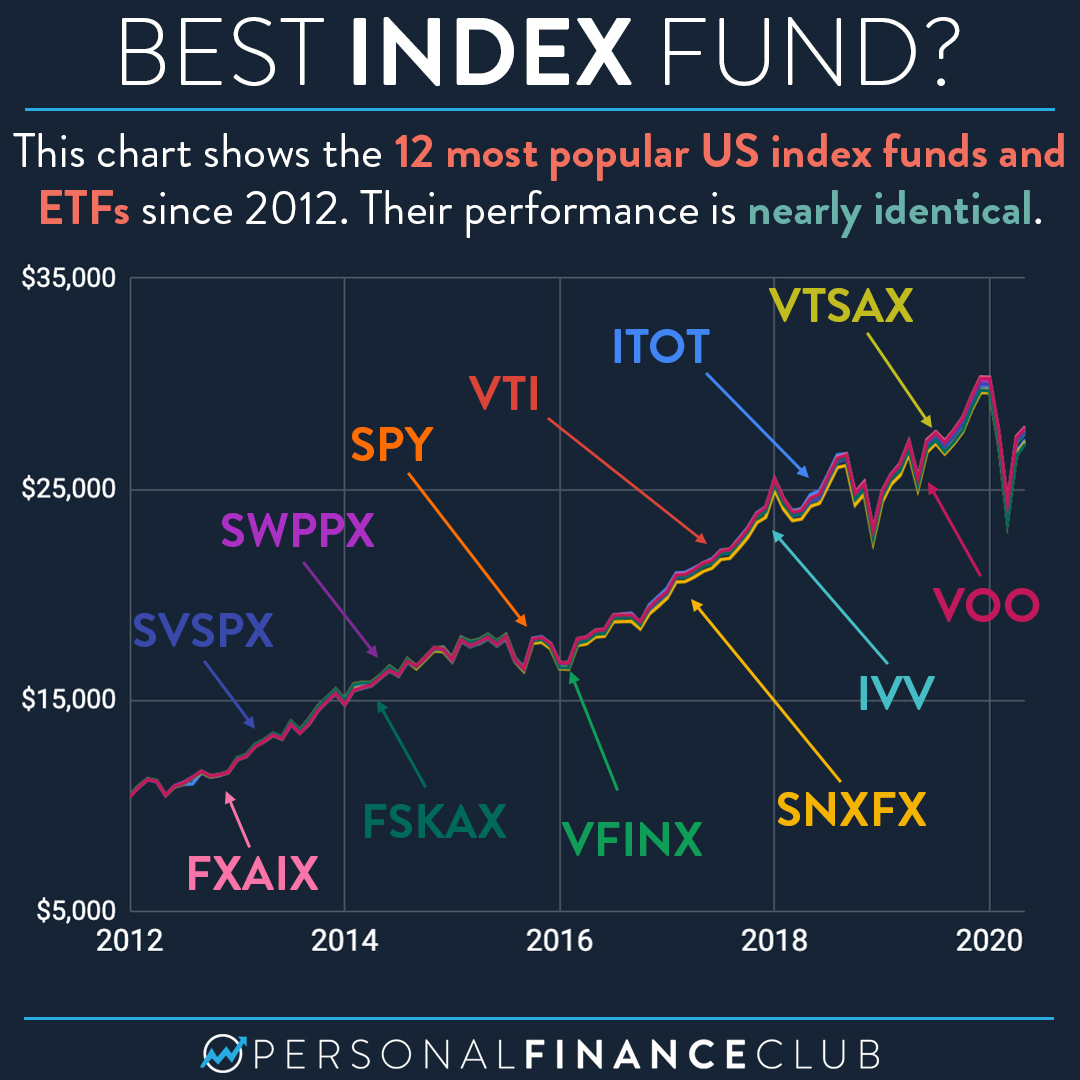

Best Low Cost Index Funds 2025. S&p 500 index funds are an excellent way to get diversified exposure to the heart of the u.s. Explore the top index funds to invest in india for 2025, including uti nifty index fund, mirae asset nifty 50 etf and more.

Investors with a high risk tolerance can optimize their portfolios for aggressive growth via these funds. Here we’ll explore what index funds are, their benefits, how they work, how to invest in them, and some of the best index funds for 2025.

Y = Sum Of All Squares Of X.

And simply mirror the returns of that index.

The H Exponent Is A Measure Of Randomness Of Nav Series Of A Fund.

Z = y/number of days taken for.

Best Low Cost Index Funds 2025 Images References :

Source: time.com

Source: time.com

Best Low Cost Index Funds 2025 TIME Stamped, Top index funds are like a package deal with automated investment packets that follow market indices. Funds with high h tend to exhibit low volatility compared to funds with low h.

Source: ysabelwflore.pages.dev

Source: ysabelwflore.pages.dev

Best Index Funds Of 2025 Jessa Luciana, Top 10 index funds in india offer a diversified portfolio of stocks or bonds at a low cost because they passively track an index's composition. Hdfc nifty 50 index fund.

Source: julianawbrooks.pages.dev

Source: julianawbrooks.pages.dev

Top Index Funds For 2025 Edyth Melisenda, Top index funds are like a package deal with automated investment packets that follow market indices. Least cost & passive way of investing in stock markets.

Source: moneyweek.com

Source: moneyweek.com

The best low cost index funds to buy now MoneyWeek, You can also buy the vanguard total bond market etf ( bnd) for a 0.03% expense ratio to sidestep the $3,000 minimum investment. And simply mirror the returns of that index.

Source: financefeatured.com

Source: financefeatured.com

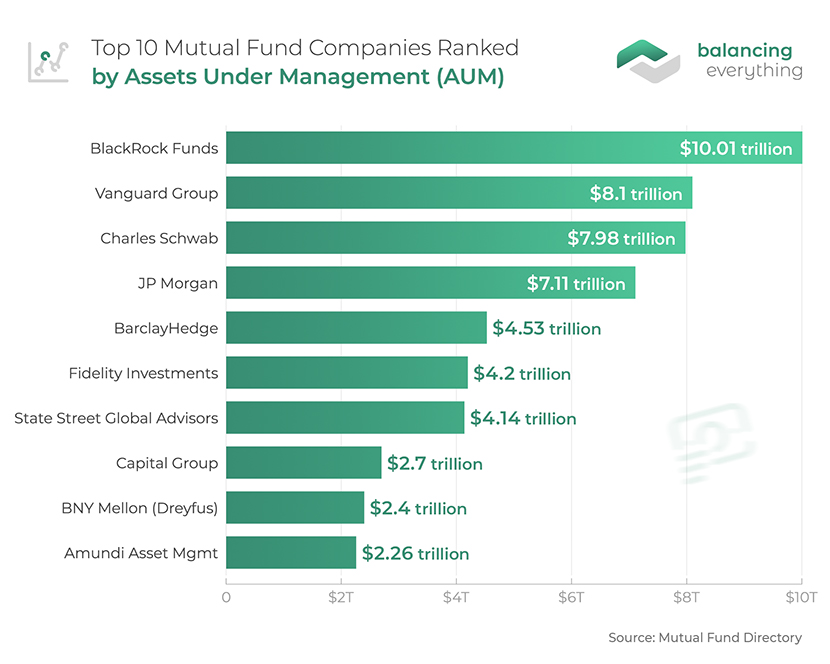

The Best Investment Companies with LowCost Index Funds for Maximum, Hdfc nifty 50 index fund. Least cost & passive way of investing in stock markets.

Source: www.stocktrades.ca

Source: www.stocktrades.ca

The Top LowCost Index Funds in Canada in July 2025 Stocktrades, Ii)when h 0.5, the series is said to be mean reverting. Here are six of the best low cost index funds across several investment styles to consider.

Source: www.youtube.com

Source: www.youtube.com

Best Index Fund for 2025 Top 1 Index Funds Best Index Mutual Funds, This type of time series is difficult to forecast. You can also buy the vanguard total bond market etf ( bnd) for a 0.03% expense ratio to sidestep the $3,000 minimum investment.

Source: moneyweek.com

Source: moneyweek.com

The best low cost index funds to buy now MoneyWeek, Vanguard s&p 500 etf (voo) one of the most popular etfs in the world, vanguard’s s&p 500 etf tracks the famous s&p 500 index and has a low 0.03% expense ratio. Investors with a high risk tolerance can optimize their portfolios for aggressive growth via these funds.

Source: ledaqhildegarde.pages.dev

Source: ledaqhildegarde.pages.dev

Best Low Cost Index Funds 2025 Edyth Haleigh, Explore affordable investment options for maximizing returns and achieving financial growth. Investors with a high risk tolerance can optimize their portfolios for aggressive growth via these funds.

Source: www.benzinga.com

Source: www.benzinga.com

Best Low Cost Index Funds Maximize Returns, Minimize Fees Benzinga, Ii)when h 0.5, the series is said to be mean reverting. Investors with a high risk tolerance can optimize their portfolios for aggressive growth via these funds.

Z = Y/Number Of Days Taken For.

The fund tracks nifty 50 index with an expense ratio of 0.36%.

Index Funds Are A Good Passive Way To Invest In The Stock Markets.

These are some of the best index funds on the market, offering investors a way to own a broad collection of stocks at low cost, while still enjoying the benefits of diversification and.

Category: 2025